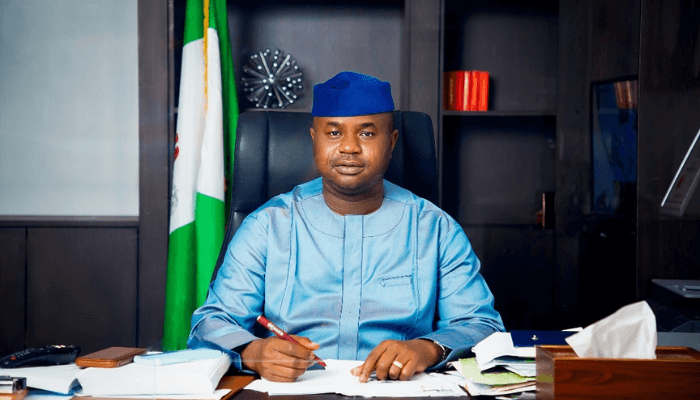

Zacch Adedeji’s tax reforms are gaining strong support across Nigeria, with many praising his leadership at the Federal Inland Revenue Service (FIRS). One notable commendation came from the Northern Renaissance Network, a policy and governance-focused group that advocates for economic progress in the North. The group described Adedeji’s approach as people-centered and economically sound.

Since taking office as Executive Chairman of the FIRS, Adedeji has shown a strong commitment to modernizing Nigeria’s tax system. He prioritizes transparency and accountability, and his team actively builds a system that encourages compliance while easing the burden on honest taxpayers. This effort has improved revenue collection and boosted public trust in the agency.

Adedeji’s tax reforms are reshaping how Nigerians understand taxation. He emphasizes tax justice, fairness, and a system that supports national development. Many believe his strategies can promote financial inclusion and reduce the country’s dependence on oil revenue. His focus on data and innovation is already delivering results, and stakeholders across sectors are paying close attention.

The Northern Renaissance Network noted that Adedeji’s leadership reflects what they call “tax reforms with a human face.” He considers the impact of each policy on the people before implementation. He bases his decisions on research and regularly consults with industry leaders and community groups. This inclusive approach ensures the tax system works better for more Nigerians.

Adedeji also prioritizes education and public awareness. He believes citizens should understand why they pay taxes and how their money is used. This mindset is changing how many Nigerians view taxation. Through outreach programs, town halls, and digital campaigns, the FIRS is strengthening its relationships with taxpayers and encouraging civic responsibility.

His reforms go beyond improving revenue—they also support small businesses. The FIRS now offers better services for SMEs, and current tax policies better reflect their realities. Many small business owners feel acknowledged and supported, making them more willing to register and comply.

The group also praised Adedeji for enforcing policy firmly while remaining open to feedback. He collaborates with state governments to harmonize tax processes, reduce duplication, and simplify the system. These efforts have lowered compliance costs and made it easier for people to pay taxes without fear or confusion.

As Nigeria continues its drive to diversify the economy, tax reforms remain essential. Adedeji’s work stands as a model of effective public service. He has earned the respect of professionals, civil society groups, and everyday citizens. His quiet focus and bold actions are ushering in a new era for tax administration.

Zacch Adedeji’s reforms are building a stronger foundation for Nigeria’s economic growth. He leads with purpose, listens to the people, and stands firm on reform. If this momentum continues, Nigeria’s tax system may soon become one of the most trusted institutions in the country.